Tag: Tax Deductions

-

The Impact of Recent Tax Law Changes on U.S. Businesses

Tax Law Changes on U.S. Businesses The United States tax system is constantly evolving, with new reforms and adjustments made to tax laws in response to changing economic conditions, government priorities, and political landscapes. For businesses, staying on top of the latest tax law changes is crucial for maximizing tax efficiency, ensuring compliance, and strategically…

-

Understanding Tax Credits and Deductions in the U.S.

Understanding Tax Credits and Deductions in the U.S. Introduction Tax credits and deductions are integral parts of the U.S. tax system, allowing individuals and businesses to reduce their taxable income and, in turn, lower their tax liability. While both serve to decrease the amount of tax owed, they function in different ways. In this guide,…

-

Tax Management Tips for U.S. Self-Employed Individuals

Title: Tax Management Tips for U.S. Self-Employed Individuals IntroductionIn today’s world, many people are moving away from traditional employment in favor of self-employment. Freelancers, contractors, and small business owners are thriving in the gig economy, but with that comes the responsibility of managing one’s own taxes. Self-employed individuals face unique tax challenges and opportunities, and…

-

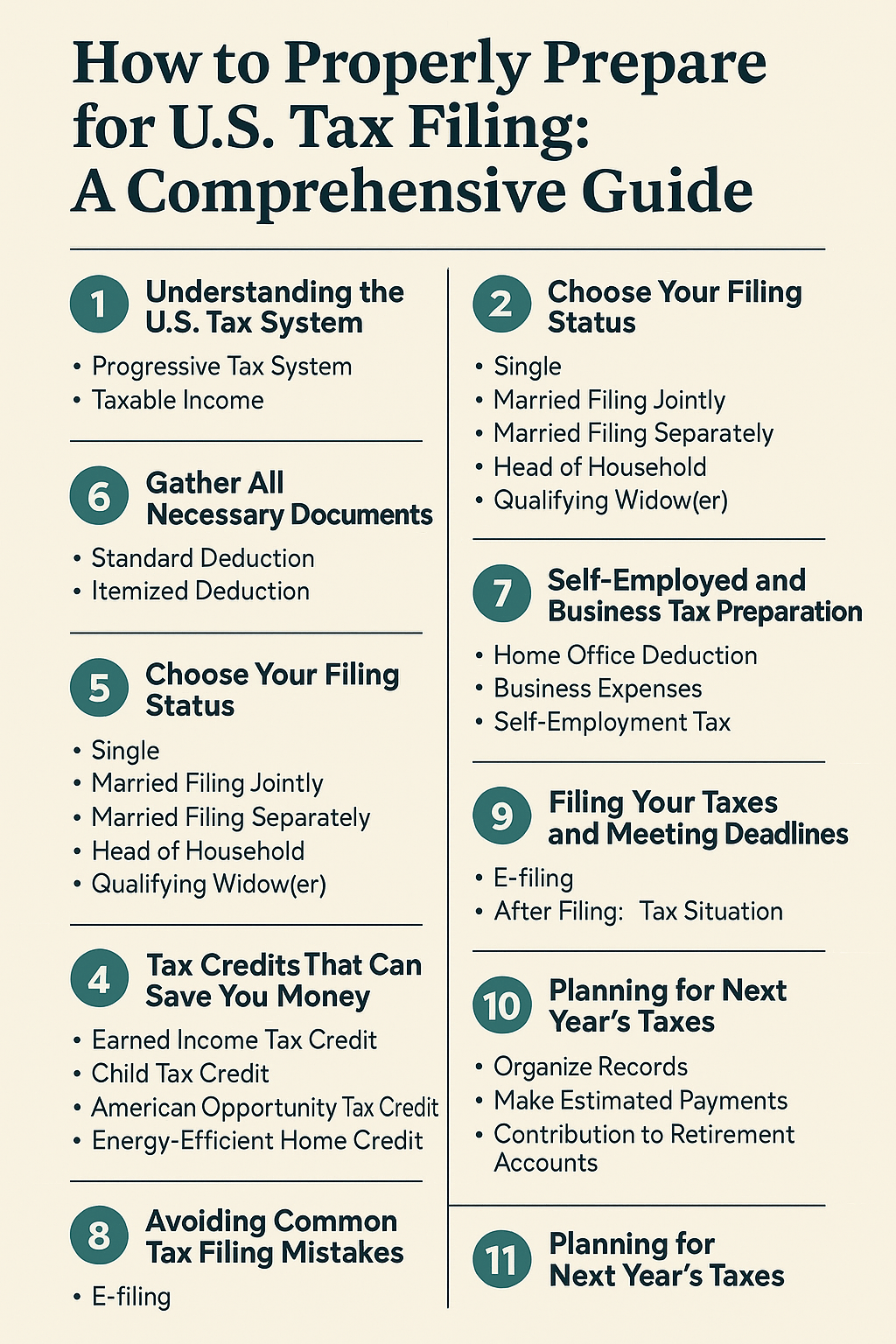

How to Properly Prepare for U.S. Tax Filing: A Comprehensive Guide.

How to Properly Prepare for U.S. Tax Filing: A Comprehensive Guide (Expanded Version)Filing your taxes doesn’t have to be a stressful and confusing process. When approached with the right mindset and preparation, tax season can be an opportunity to maximize your savings, minimize your liabilities, and ensure you’re fully compliant with the law. The U.S.…